Author: Chad Farnum

-

Wellness Exam

A Medicare wellness exam is a special type of physical exam specifically designed by Medicare for the needs of people 65 and older. A Medicare beneficiary is untitled to one “Welcome to Medicare” initial wellness exam within the first 12 months after first enrolling in Medicare Part B, and then one wellness exam every year thereafter. Medicare pays…

-

Annual Notice of Change (ANOC)

If you currently have a Medicare Advantage Plan or you’re enrolled in a stand-alone Medicare Part D Prescription Drug Plan, your plan will send you a “Plan Annual Notice of Change” (ANOC) by the end of each September. The ANOC includes any changes in coverage, costs, or service area that will be effective in January.…

-

Medicare and Skilled Nursing

If you or a loved needs care in a Skilled Nursing Facility (SNF), either for a short-term rehabilitation, or a long-term stay, it is crucial to know what Medicare covers and what you will need to pay for these services. First and foremost, the skilled nursing facility you choose must be certified by Medicare. Patient Criteria…

-

Medicare Out-of-Pocket Costs You Should Expect to Pay

Medicare provides valuable health insurance for individuals 65 or older and certain people with disabilities who are under age 65. But it also comes with complex rules and sometimes significant out-of-pocket costs. Here are the Medicare Out-of-Pocket costs you should expect to pay: Premiums Most beneficiaries pay the standard Medicare Part B premium of $185 per month…

-

Understanding Your Initial Enrollment Period

Your initial enrollment period (IEP) is the earliest time that you’re entitled to sign up for Medicare. Typically occurring around the time you reach age 65. Be aware the Social Security Administration automatically enrolls you in Medicare Parts A and B if you’re already receiving Social Security disability or retirement payments by the time your…

-

Part D & the $2,000 out-of-pocket max

I recently had a question from a client regarding the annual $2,000 out-of-pocket maximum that’s now apart of every Medicare Part D drug plan. To be clear, the $2,000 max only applies to drugs that are covered on your particular drug plans formulary. Said another way, if a drug is not covered on your plans…

-

Medicare’s Gaps for Dental, Hearing and Vision Coverage

The older we get, the more likely we will need professional attention for our ears, eyes, teeth, and feet. Medicare has never covered so-called routine dental care, including care that you and I would consider essential to our health. Routine is the key word here. Medicare pays to treat problems it considers medically necessary. It…

-

Advantages of Working with a Local Licensed Agent

There are several advantages of utilizing a local licensed agent for your Medicare or other individual health insurance needs. Chief among them is trust, being able to put an actual face with a name connected with your local community and not dealing with a call center in another state or even one outside of the country. Next…

-

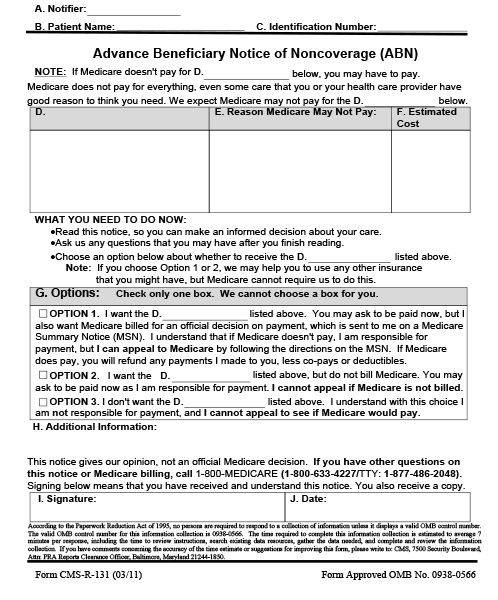

Advance Beneficiary Notice of Noncoverage

This is how the Advance Beneficiary Notice of Noncoverage works, if you have Original Medicare and any provider or supplier thinks that Medicare probably (or certainly) won’t pay for items or services because Medicare deems the treatment not medically necessary, that provider or supplier is required to provide you with a written notice called an “Advance Beneficiary Notice of Noncoverage”…

-

Does Your Doctor Accept Medicare

Over ninety percent of physicians participate in Medicare. It’s called Medicare Assignment, and if your provider accepts Medicare Assignment, there will be no Excess Charges outside of your Part B deductible ($257 in 2025). There are basically four types of relationships a physician can have with Medicare. Most of the time if you have been with…